You must additionally provide anyone that occasionally drives your vehicle (low cost auto). While the policy only needs you to note "popular" drivers, insurance providers commonly analyze this term broadly, and also some require that you detail anybody who might utilize your lorry. Generally, chauffeurs that have their very own car insurance coverage can be noted on your policy as "deferred operators" at no added fee.

You can typically "leave out" any type of family participant that does not drive your vehicle, however in order to do so, you need to submit an "exclusion form" to your insurance business. car. Chauffeurs that only have a Student's Authorization are not required to be provided on your plan till they are totally certified.

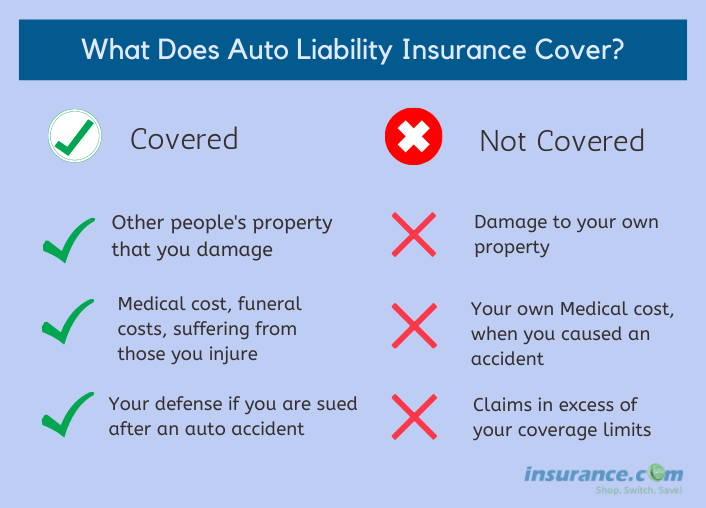

Many states require that you carry car responsibility insurance coverage in particular minimal amounts. If you are at fault in a mishap, the law requires that you pay the problems endured by the individual that is not responsible. These can consist of residential or commercial property damage, which is the expense to fix or replace any type of residential property that you have damaged. cheap car insurance.

No-fault programs are made to minimize the price of auto insurance policy by decreasing insurance claims as well as litigation. Regarding one-half of the states have actually established some sort of no-fault or automobile insurance reform legislation - cheap car. The laws bordering no-fault insurance policy differ widely, so you should contact your insurance commissioner's office or an insurance coverage representative for needs in your state.

A person that is using your car, pick-up, or van with your permission will likewise be covered. At the time the policy is provided, you will select the limitations of obligation that you want. The restrictions that you select are one of the most that we will certainly pay in the occasion of a loss. credit.

The 8-Minute Rule for What Is Liability Car Insurance? - Auto - Us News & World ...

At the time the policy is provided, you will certainly pick a coverage limitation. Underinsured Vehicle Driver Protection Even though obligation protection is a good idea as well as commonly required, there are lots of reckless chauffeurs who do not buy insurance coverage.

However, if you acquire without insurance driver insurance policy, your insurer will pay you for the residential property damages and bodily injury. It will certainly cover you, member of the family, and also anyone else inhabiting an insured car. The limits for this protection are generally the same limitations that you picked for liability, although you can select lower limitations.

In some states, underinsured vehicle driver insurance coverage is included in your without insurance vehicle driver insurance coverage - dui. In other states, you can buy underinsured vehicle driver insurance coverage, which covers your excess losses up to the restriction set forth in the plan. Comprehensive and also Crash If you have extensive and also collision insurance coverage, your insurer will certainly pay for damages to an insured vehicle, regardless of mistake.

For a lot more on all the kinds of protections, see listed below. What Is Obligation Car Insurance Policy Coverage? Obligation insurance coverage extends to you, your spouse, as well as any type of resident member of the family for Get more info the ownership, upkeep, or use of any type of car, pickup, or van unless especially restricted by your plan. Simply put, obligation vehicle insurance coverage spends for injuries and/or problems that you create to another person in a crash.

Of training course, we recommend that you bring a lot extra responsibility automobile insurance than the minimum. Or else, if the injuries as well as problems are severe, you may end up paying for them out of your very own pocket. cheaper cars.One of our agents will enjoy to advise the correct amount of car obligation insurance for you.

Little Known Questions About Insurance - Motor Vehicle Division Nm - Mvd New Mexico.

If you have a present auto insurance plan, your rental car may currently be covered. There are also some bank card that will cover your rental vehicle in situation of a crash. Prior to you lease your next car, check with your insurance coverage company or bank card business and also locate you've currently got rental auto insurance coverage. insurance.

What is the difference in between detailed cars and truck insurance coverage and crash insurance? Crash insurance policy is defined as losses you incur when your automobile collides with another cars and truck or item. vans. As an example, if you hit a cars and truck in a parking area, the damages to your cars and truck will certainly be paid under your accident coverage.

Can a person else drive my car under my insurance? Many of the time when you purposefully loan your vehicle to a close friend or a partner, they will certainly be covered under your car insurance coverage policy.

Automobile owners in Colorado are called for to bring liability insurance coverage. Obligation insurance policy covers physical injury to another person or residential or commercial property damage to an additional's vehicle or building when the insured is at mistake for a crash. The complying with minimum protections are called for by the state, although higher insurance coverages may be bought: $25,000 for physical injury or death to any type of one person in an accident; $50,000 for bodily injury or fatality to all persons in any type of one mishap; and $15,000 for home damages in any one mishap.

The Insurance Commissioner must make certain that the person will certainly be able to pay the minimal protections called for by the state - credit. For additional information on selfinsurance, get in touch with the state's Department of Insurance coverage within the Department of Regulatory Agencies (DORA).

All about Liability Car Insurance

It is feasible to acquire even more insurance coverage protection than the minimum level of coverage needed. Liability insurance protection protects you only if you are responsible for a crash as well as pays for the injuries to others or problems to their property. It does not give protection for you, your passengers who are your resident family members, or your residential or commercial property - insurance affordable.

What other kinds of coverage can I buy? Vehicle drivers who intend to shield their lorries against physical damages can require to purchase: This insurance coverage is for damages to your vehicle arising from a crash, despite that is at fault. insurance affordable. It attends to repair service of the damage to your automobile or a monetary payment to compensate you for your loss.

It also pays for dealing with injuries resulting from being struck as a pedestrian by an electric motor vehicle. Your vehicle insurance deductible is the amount of money you have to pay out-of-pocket before your insurance coverage compensates you. insure.

You have a Subaru Wilderness that has Crash Protection with a $1,000 insurance deductible. In this situation, you would pay the body store $1,000.

When you have satisfied your $1,000 deductible the insurance policy company will pay the remaining $5,500. Just how does my deductible influence the expense of my insurance coverage?

Not known Incorrect Statements About Florida Insurance Requirements

How do I buy car insurance policy? When buying insurance policy, the Division of Insurance policy suggests that you look for the suggestions of a competent insurance expert. There are 3 sorts of specialists that typically market insurance: Independent representatives: can market insurance coverage from numerous unaffiliated insurance firms. Exclusive agents: can just offer insurance policy from the business or team of business with which they are associated.

No matter what kind of specialist you choose to use, it is essential to validate that they are accredited to perform service in the State of Nevada. You can inspect the certificate of an insurance coverage expert or firm right here. Keep in mind Constantly validate that an insurance provider or agent are licensed before providing personal details or repayment.

These variables consist of, but are not limited to: Driving record Claims history Where you live Gender as well as age Marital Standing Make and version of your automobile Debt Nevada has one of the most competitive and also healthy automobile insurance coverage markets in the country (cars). Buying for insurance policy may allow you to attain affordable prices.

To discover using your credit scores information by insurer review our Often Asked Inquiries Regarding Credit-Based Insurance Coverage Scores. cars.

Home damage responsibility insurance coverage pays for damages you cause to the residential property of others. Crash protection pays for physical damage to your car as the outcome of your auto colliding with an object.

A Biased View of Automobile Insurance Information Guide

You and relative listed on the plan are also covered when driving a person else's auto with their permission. It's extremely crucial to have enough responsibility insurance coverage, because if you are associated with a severe crash, you may be filed a claim against for a large amount of cash. It's advised that insurance holders buy greater than the state-required minimum liability insurance, sufficient to protect properties such as your house as well as savings.

At its broadest, PIP can cover clinical repayments, shed salaries as well as the price of changing solutions usually performed by someone hurt in an automobile crash. credit score. It might additionally cover funeral prices. Property damage liability This protection spends for damages you (or a person driving the automobile with your approval) might trigger to another person's property.

Accident Accident protection pays for damage to your car arising from a crash with another cars and truck, a things, such as a tree or telephone pole, or as a result of flipping over (note that crashes with deer are covered under extensive). It additionally covers damages brought on by holes. Accident insurance coverage is generally offered with a separate insurance deductible.

If you're not at mistake, your insurance provider might try to recover the amount they paid you from the other motorist's insurer and also, if they achieve success, you'll also be compensated for the deductible. Comprehensive This insurance coverage repays you for loss because of theft or damage triggered by something apart from a collision with another cars and truck or item.

Searching for car insurance policy? Here's just how to locate the best policy for you and also your cars and truck..

Liability Auto Insurance 101 - Ramseysolutions.com Fundamentals Explained

Liability insurance coverage also will certainly pay for your lawful protection costs if you are sued as an outcome of your involvement with the accident. Who needs liability insurance policy? Anyone who drives a lorry needs Liability insurance. In many scenarios, Liability insurance policy is needed by legislation. For-hire truckers operating under their own authority must have Obligation insurance coverage in order to acquire a declaring.

$30,000 would be the most your insurance coverage would pay for all individuals harmed in the crash. $10,000 would certainly be one of the most your insurance coverage would pay for all property harmed in a solitary crash - cars. With a combined single restriction, or CSL, just one number is utilized to explain the restrictions for both Bodily Injury insurance coverage and also Property Damages insurance.

For example, if you selected a mixed single limit of $1 million, your insurance provider would certainly compensate to $1 million for all clinical as well as injury-related costs and all home damage expenditures that you caused in a crash. Responsibility insurance policy instance: You can not stop your van in time, and rear-end the auto before you.

Several automobiles If one vehicle on the policy has Responsibility insurance policy, all of the vehicles need to have it. The picked Responsibility limitations must coincide for all vehicles on a policy. State minimums Each state establishes regulations concerning just how much Obligation insurance policy its locals are required to have. This is known as your state's minimal limitations or minimum limit requirements. liability.

Obligation insurance coverage is mandated by regulation in 49 of 50 states, with varying limits, and protects those that have actually suffered loss. Both components bodily injury as well as building damage are third-party benefits, one that the vehicle driver can not use personally. Responsibility insurance policy is mandated by legislation in 49 of 50 states, with varying limitations, and also secures those who have experienced loss.