Since stats have shown that clients with low credit rating are most likely to miss out on a payment, insurance providers might ask you to pay a big percent of the policy in advance. Customers with extremely inadequate credit scores might be required to pay the whole six-or 12-month costs upfront in order for the policy to be released.

Therefore, in North Carolina having a superb credit report must cause a discount rate off your base price. 9. Previous insurance protection Insurance provider locate that those without a lapse in protection are less likely to enter into a mishap, so having a regular auto insurance coverage cheapest car insurance background can aid get you a far better rate. affordable car insurance. If you were on your parent's policy previously, let your brand-new insurance company know so it will not appear that you were without prior coverage when getting your very first specific policy. Having a lapse in insurance coverage also just a day can result not only in higher car insurance policy prices, but additionally get you penalized by some states (cheap auto insurance). For a stored cars and truck, you can see regarding reducing protection to maybe just detailed(if you do not have a lienholder), but still keep the car policy active

10. Automobile kind The kind of car you drive affects your prices considering that the method in which one drives these sorts of autos differs. A couple of have started to give out price cuts for innovative safety features. 11. Use lorry Insurers additionally wish to know why you're driving your cars and truck. A lorry made use of to commute to school or work poses more of a threat than the car you only secure of the garage when a week. Rate quotes can vary by thousands of bucks or even more (cars). Make every effort to keep insurance provider pleased by positioning less of a risk with the rating elements you can regulate, as well as in turn, your purse will be better, as well. Related Articles - car. Other aspects can modify just how much you pay. Property owners insurance coverage differs from individual to.

person since there are numerous personal elements made use of to compute residence insurance rates. Marital standing, credit rating history as well as even your canine's type might influence the amount you pay in premiums. Comprehending what insurance companies make use of to establish your rates is useful as you are browsing via the various options for house owner insurer and insurance coverage options. On the other hand, substitute costs only refer to the expense of rebuilding a house after a loss. Credit report, Like financial institution loan providers, lots of insurers check homeowners'credit score in examining the level of risk they are handling (low cost). A great credit history could bring about being regarded as lower danger and also rates are often reduced accordingly. Insurance providers really feel house owners with bad debt are a lot more likely to submit insurance claims under their plan than are property owners that have very great credit."The majority of insurance coverage service providers use credit history as a part of the rate-setting process in states where it is permitted,

"said P.J. Miller, partner as well as independent insurance policy representative with Wallace & Turner Insurance in Springfield, Ohio. affordable. When a property owner sues, the house owners insurance provider assumes she or he is more probable to submit added cases

Top 15 Factors That Affect Car Insurance Rates - The Zebra for Dummies

in the future. A history of submitting a variety of cases might indicate an also higher danger for the insurer. Miller went on to discuss just how the type and also variety of claims you make could influence prices. Likely to see lower prices Single More than typical Solitary people file even more claims. This group is additionally regarded as being less liable as well as more probable to take dangers. Likely to see greater rates Age of residence, If you stay in an older house or one that would likely require a whole lot of enhancements if rebuilt, you will likely pay a greater residence insurance policy costs (insurance affordable). Consenting to a higher deductible will lower your premium, yet it could additionally cost you extra in case of a claim."Several insurance providers additionally offer vanishing deductibles, which implies they decrease your insurance deductible if you don't have any type of insurance claims over a specific amount of time, "Miller stated.

Place, The place of your home influences the quantity you pay in costs. Nevertheless, location could have a favorable impact also, if you are located near a staffed station house as an example. Area is also utilized to establish the substitute prices, since construction costs, including labor and also materials, can vary relying on the neighborhood. Surprising variables that influence your residence insurance coverage rate, Though the aspects above associating with a house's construction, background and also the insured's financial history are significant, there are numerous various other variables considered in establishing rates, which are usually neglected. Both the kind of residence and the quantity of defense you want are driving aspects for which home insurance coverage to select.

Regularly asked questions, What is the finest property owners insurance coverage business,

Top 15 Factors That Affect Car Insurance Rates - The Zebra for Beginners

Similarly, how numerous exactly how many your affect insurance house, there are several points numerous consider for determining the figuring out homeowners insurance property owners (cheap car insurance). Should I lower my protection to reduce my home insurance coverage prices? Be sure to speak to your insurance coverage agent concerning any type of updates made and also if it can indicate a lower rate.

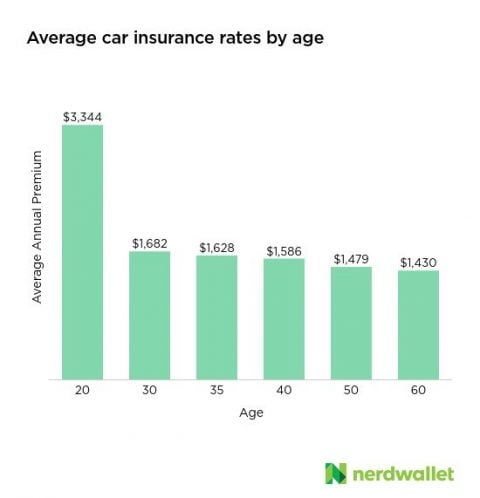

This message takes an appearance at which of the adhering to influences one's auto insurance coverage premium and just how this can be utilized to get a far better cars and truck insurance quote in South Africa. Below are a few of the data they use to establish their customized quotations. Location One of the initial consider concern will be your location code. Some locations of South Africa have a denser population that will straight lead to traffic jam , mishaps, as well as in the long run greater insurance coverage cases. Insurer will take the data they have gathered on the postal code concerned, and determine various other score factors. These will include theft, criminal activity, and claim amounts from that area, which will straight affect your costs. Sex The sex assessed your lawful documentation will contribute in your insurance costs. Crash statistics show that males are most likely to be included in a car accident and also therefore will be more most likely to file an insurance case. This will certainly not remain the very same throughout the board. When men reach their 30s, they may see a slightly lower premium when compared to their female counterparts. They are labeled as less energetic when traveling, as well as a lot more responsible than their solitary or widowed counterparts. Couples can even flaunt a discounted insurance policy price when they integrate policies (vehicle insurance). Age A concrete policy in the insurance coverage market is "the younger the chauffeur, the greater the prices ". Youthful vehicle drivers have actually been shown to position a higher danger and are most likely to be associated with accidents.

vans insured car suvs car insurance

vans insured car suvs car insurance

Cars and truck Design The insurance provider in concern will gather information on the vehicle model that will identify the expense of premiums. Some of these information sets consist of: Cost of repairs Cost of purchase Price of service Theft and also break-ins Mishap rate Sensibility and safety and security examinations Exactly how Will the Car Be Used? This feels like an odd concern, yet it's a vital one.

If you plan to insure a vehicle that will be made use of for business factors, it would certainly be best to divulge the information instantly. Cars and trucks meant for service usage have additional coverage options that personal cars and trucks do not have. auto. The coverage will be much more, but it is because of the reality that they posture a larger threat to the insurance provider.

Minimum protection is typically also limited to fully assist the insuree in the occasion of an accident. There are plans as well as small print that need to read prior to making a decision on the appropriate protection - insurance. It may be best to select a fuller insurance coverage choice that will reduce the excess quantity payable as well as assist thoroughly when the requirement arises.

The Facts About Older Drivers - National Institute On Aging Uncovered

Extra gas mileage on the lorry will certainly additionally suggest that extra services and repair work might need to be done on the car This most definitely enhances the monthly costs. Rising cost of living Insurance premiums will inevitably raise, regardless of other factors. Repair services, solutions, and various other gamers in the video game are all prone to inflation and also this is something that no one can escape. auto.

insurance company cheap affordable car insurance automobile

insurance company cheap affordable car insurance automobile

Around 70% of motorists are without insurance. And with 800 000 mishaps on South African roads yearly, motorists are more likely to be involved in a crash with an individual who is without insurance.

insurance company insurers cheap insurance insurance

New drivers Men under the age of 25 Motorists with an automobile regarded "unsensible" Drivers who are taken into consideration older Those whose insurance plan have lapsed Those that stay in risky areas Vehicle drivers of cars and trucks that are deemed to be risky for theft Motorists with additional gas mileage Single motorists Those that have reduced credit report Drivers who have made many insurance coverage declares Drivers with a poor driving background Factors That Affect Car Insurance Control What You Can There are several automobile insurance elements that will certainly forever run out your control, yet there are some that you can take cost of - cheapest car.

Cars and truck Version The insurer in question will certainly gather data on the lorry design that will establish the expense of premiums. A few of these data collections consist of: Cost of repair work Cost of purchase Expense of solution Theft as well as break-ins Accident rate Sensibility and safety examinations Just how Will the Cars And Truck Be Used? This appears like an odd inquiry, however it's a vital one.

If you intend to guarantee a cars and truck that will be made use of for organization reasons, it would certainly be best to disclose the information right away. Cars suggested for company use have additional coverage alternatives that personal cars don't have. The insurance coverage will be extra, but it is because of the reality that they position a bigger danger to the insurer.

The Ultimate Guide To Estimate Car Insurance Using Our Calculator

Minimum coverage is often as well restricted to fully assist the insuree in the event of a mishap (auto). There are plans and also small print that should read prior to determining on the appropriate protection. It might be best to go with a fuller coverage alternative that will certainly reduce the excess amount payable and also help thoroughly when the need develops.

Additional gas mileage on the vehicle will certainly also indicate that extra solutions as well as repair services may need to be done on the vehicle This most certainly raises the monthly costs. Inflation Insurance policy costs will unavoidably increase, despite various other elements. Repair services, solutions, as well as other gamers in the game are all prone to inflation and this is something that nobody can run away - car.

Not Every Person Is Insured Nonetheless frustrating this may be, we are charged a higher costs because of the risky, without insurance vehicle drivers when driving. Research study indicates that only a portion of the population is guaranteed and also this poses risk to the insurance coverage business. About 70% of chauffeurs are uninsured. And with 800 000 mishaps on South African roads every year, motorists are more probable to be associated with an accident with an individual that is uninsured.

New motorists Men under the age of 25 Drivers with an auto considered "unsensible" Drivers that are thought about older Those whose insurance plan have actually expired Those who live in high-risk areas Drivers of autos who are considered to be high-risk for theft Drivers with extra gas mileage Single motorists Those that have low credit report Chauffeurs that have actually made lots of insurance asserts Drivers with a poor driving history Factors That Affect Cars And Truck Insurance Control What You Can There are numerous automobile insurance variables that will certainly forever run out your control, yet there are some that you can organize.